tax strategies for high income earners australia

How Much Do High-Income Earners Spend on Taxes. However the tax benefits.

Tax Strategies For High Income Earners 2022 Youtube

A donor-advised fund DAF is an investment account created to support.

. For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. Contribute to your Superannuation. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income earners on this list.

Equity should be made an explicit objective of the super system and the government should raise taxes on high income. An easy way to avoid paying this for high-income earners is by acquiring private health insurance hospital cover making it an easy way to reduce tax. This is an important strategy for residents of high-income tax states with significant investment income.

As a refresher for 2021 fy. Set up a discretionary trust. 6 Tax Strategies for High Net Worth Individuals 1.

Another tax planning strategy for individuals that. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners. Under RS rules you can deduct charitable cash contributions of up to.

This article lists seven strategies you should consider. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super. Max Out Your Retirement Account.

So what are the top tax planning strategies for high income employees. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. How Much Does A High Income Earner Earn In Australia.

Superannuation contribution options to reduce taxes. 1 day agoThe retirement income review showed that at 5 million youre getting 70000 of tax concessions per annum Ms Stewart said. Take Advantage of Pre-Tax Savings Opportunities.

One out of the many. You must however be. Despite the ever-changing socioeconomics there are several strategic ways to protect ones income and investments that will hold true throughout nearly all administrations.

One of the most popular tax-saving strategies for high-income earners involves charitable contributions. A Solo 401k for your business delivers major opportunities for huge tax. That is more than the median income in Australia.

1 day agoLabor urged to cut super tax breaks for higher earners. The good news is that there are numerous tax-reduction techniques available for high-income taxpayers if you happen to be in the higher tax bracket. Business owners hire your kids.

Implementing tax minimisation strategies is crucial for high-income earners. High-income earners are spread across multiple brackets the tax rate being different based on their status ie single filer joint filer. Lets review five of the most highly effective retirement tax strategies for high income earners.

As a refresher for 2021 FY the individual tax rates including medicare levy are. How to Reduce Taxable Income. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Tax Minimisation Strategies For High Income Earners

How To Pay Less Taxes For High Income Earners Wealth Safe

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

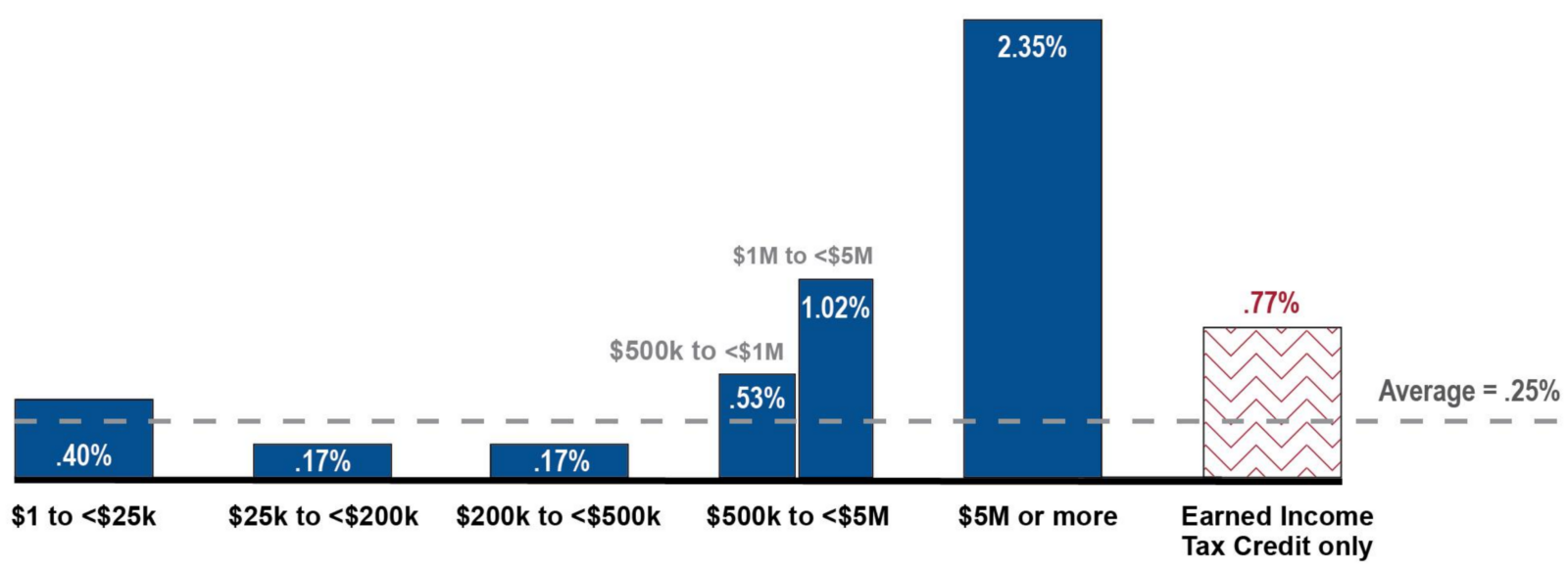

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

Tax Strategies For High Income Earners 2022 Youtube

Tax Minimisation Strategies For High Income Earners

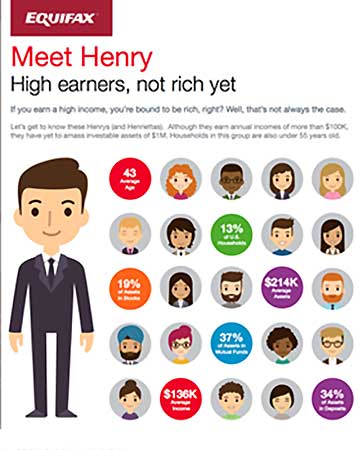

Meet Henry High Earners Infographic Equifax

Tax Saving Strategies For High Income Earners Smartasset

Tax Free Wealth How To Build Massive Wealth By Permanently Lowering Your Taxes Rich Dad Advisors Wheelwright Tom 9781947588059 Amazon Com Books

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Stage Three Tax Cuts For Highest Income Earners To Give Men Double The Amount As Women R Australia

Us Super Rich Pay Almost No Income Tax Bbc News

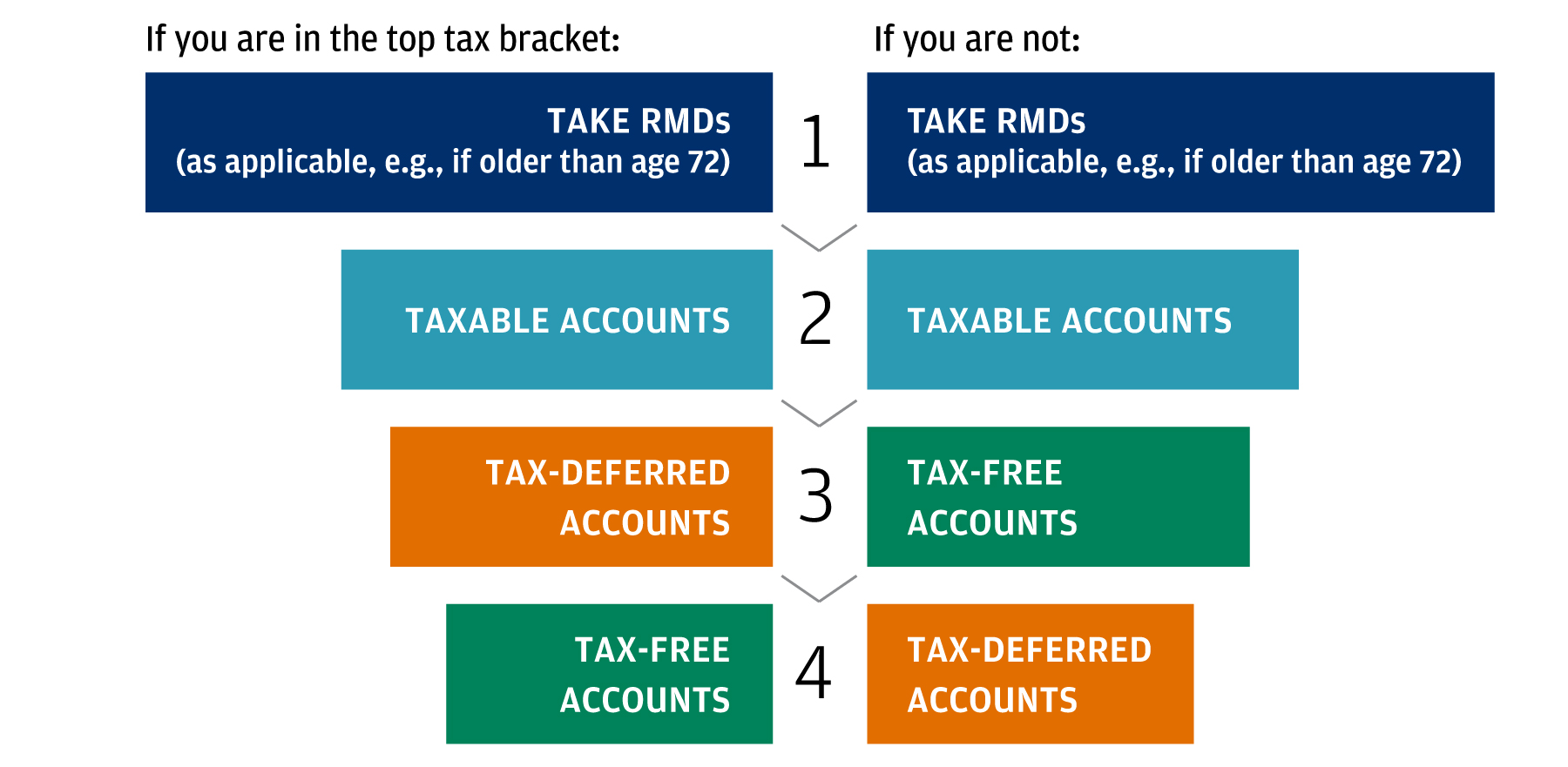

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

Tax Season Archives Cpa Trendlines

Arizona Voters Approve Massive Tax Hike On High Earners Could Your State Be Next

Roth Ira Rules Contribution Limits And How To Get Started The Motley Fool